Colombia & Mexico Restructuring

A&M's Latin America Restructuring team offers critical assistance to companies that are under performing, in crisis, or healthy with under-performing divisions. We bring a distinct hands-on approach to complex operational and financial challenges requiring speed to execution.

Our solutions:

A&M services companies facing underperformance or crisis scenarios. A&M assist its clients in navigating complex situations and provide specialized advice. Our expertise extends to financial restructuring, turnaround, debt renegotiation, and strategic wind-down.

Integrated restructuring partnership:

- Ensure a balanced approach during critical corporate restructuring phases, addressing immediate needs while strategically charting a sustainable course for the future.

- Conduct in-depth liquidity reviews and weekly cash flow forecasts to address immediate liquidity concerns.

- Collaborate closely with your team to evaluate strategic alternatives, considering various scenarios and selecting the most viable path forward in alignment with the board and management.

Comprehensive operational support:

- Work hand-in-hand with your team to stabilize operations, facilitating communications processes and ensuring seamless coordination between stakeholders.

- Create and enhance business plans, emphasizing cost reduction initiatives and execution milestones, while enforcing strict guidelines and controls for cash conservation.

Strategic pathway and execution:

- Manage actively creditor negotiations and evaluate avenues for revenue enhancement, aligning every step with an overarching operational restructuring plan.

- Serve as the linchpin in the restructuring process, quarterbacking the efforts to ensure a cohesive and timely execution of plans.

A&M takes quick actions, builds trust with stakeholders, and provides credible and practical advice to ensure lenders’ value.

- Conduct a rapid assessment of opportunity and risk, deep understanding of the situation.

- Act as representative for the lenders, provide negotiations support thought the restructuring process

- Identify alternatives for the lenders, understand ability of business and management to deliver

- Develop aggressive & realistic plans

- Negotiate adjustments and extensions for current facilities, optimizing working capital, obtaining and enhancing credit ratings, and exploring refinancing alternatives

- Keep creditors informed on company’s related progress and recent information

- Work with attorneys to ensure proper documentation and economics reflected from lenders perspective

- Advise on alternative structures

A&M takes quick actions, builds trust with stakeholders, and provides credible and practical advice to ensure lenders’ value.

- Conduct a rapid assessment of opportunity and risk, deep understanding of the situation.

-

Act as representative for the lenders, provide negotiations support thought the restructuring process.

- Identify alternatives for the lenders, understand ability of business and management to deliver.

- Develop aggressive & realistic plans.

- Negotiate adjustments and extensions for current facilities, optimizing working capital, obtaining and enhancing credit ratings, and exploring refinancing alternatives.

- Keep creditors informed on company’s related progress and recent information.

- Work with attorneys to ensure proper documentation and economics reflected from lenders perspective.

- Advise on alternative structures.

A&M takes quick actions, builds trust with stakeholders, and provides credible and practical advice to ensure lenders’ value.

- Conduct a rapid assessment of opportunity and risk, deep understanding of the situation.

-

Act as representative for the lenders, provide negotiations support thought the restructuring process.

-

Identify alternatives for the lenders, understand ability of business and management to deliver.

-

Develop aggressive & realistic plans.

-

Negotiate adjustments and extensions for current facilities, optimizing working capital, obtaining and enhancing credit ratings, and exploring refinancing alternatives.

-

Keep creditors informed on company’s related progress and recent information.

-

Work with attorneys to ensure proper documentation and economics reflected from lenders perspective.

-

Advise on alternative structures.

A&M takes quick actions, builds trust with stakeholders, and provides credible and practical advice to ensure lenders’ value.

- Conduct a rapid assessment of opportunity and risk, deep understanding of the situation.

-

Act as representative for the lenders, provide negotiations support thought the restructuring process.

- Identify alternatives for the lenders, understand ability of business and management to deliver.

- Develop aggressive & realistic plans.

- Negotiate adjustments and extensions for current facilities, optimizing working capital, obtaining and enhancing credit ratings, and exploring refinancing alternatives.

- Keep creditors informed on company’s related progress and recent information.

- Work with attorneys to ensure proper documentation and economics reflected from lenders perspective.

- Advise on alternative structures.

A&M takes quick actions, builds trust with stakeholders, and provides credible and practical advice to maximize the Company’s value.

- Conduct rapid assessment of opportunity and risk.

- Act with a deep understanding of the situation ensuring the company is accurately represented.

- Identify alternatives for the company, understand ability of business and management to deliver.

- Provide negotiations support through the restructuring process

- Ensure value for the company and shareholders.

- Enable communication and keep the company informed on creditor’s related progress and recent information.

- Work with attorneys to ensure proper documentation and economics reflected from the company’s perspective.

- Advise on alternative structures.

A&M executives bring a fresh action-oriented approach, an ability to develop game plans as well as the knowledge and expertise to execute them in an accelerated time frame while navigating turbulent times.

- Provide experienced professionals to act as a Chief Executive Officer (CEO), Chief Restructuring Officer (CRO), Chief Financial Officer (CFO), among others. These professionals will provide crucial stability and guidance to clients, customers, creditors and employees.

- Respond promptly to minimize adverse impact on executive turnover, overseeing communication processes with board members, management, creditors, and employees. If needed, handling financial and/or operational planning and administration.

- Immediate hiring of senior management personnel to provide interim leadership in functional areas according to the client's needs (i.e., CEO, CFO, COO, treasury, etc.). Rapid rapport with client teams, Always prepared for the unexpected, agile if corrections need to be made in the course of the consultancy.

- Monitor the company's operations from start to finish, developing and implementing strategies to enhance performance.

A&M offers comprehensive M&A services to support your buy- and sell-side transactions across the entire deal lifecycle.

M&A is a key enabler to business strategy. Providing assistance to assess the company’s businesses with fresh eyes and develop strategies that employ mergers, acquisitions and divestitures as a lever to improve enterprise performance and the competitive health of the business.

- Strategy: define and execute M&A strategies that support growth and improve performance, Advise Company / BOD in evaluation and execution of strategic alternatives.

- Valuation services: service a strong demand of independent valuation services, regardless of company size, industry, or asset type.

- M&A negotiation: act on experience in structuring and negotiating transactions, Senior members of the A&M team are extremely involved in this highly sensitive portion of any transaction.

- Transaction planning & execution: accelerate integration and separation activities to capture value.

- Value & optimization: realize the full potential of your transaction and optimize performance post-deal.

- Alliances: source JV and strategic alliance and undertake negotiations.

- Coordination of tax & legal matters: Manage and act as “quarterback” for transactions, ensuring that all parties act in congress and that no detail is overlooked.

A&M services companies facing underperformance or crisis scenarios. A&M assist its clients in navigating complex situations and provide specialized advice. Our expertise extends to financial restructuring, turnaround, debt renegotiation, and strategic wind-down.

Integrated restructuring partnership:

- Ensure a balanced approach during critical corporate restructuring phases, addressing immediate needs while strategically charting a sustainable course for the future.

- Conduct in-depth liquidity reviews and weekly cash flow forecasts to address immediate liquidity concerns.

- Collaborate closely with your team to evaluate strategic alternatives, considering various scenarios and selecting the most viable path forward in alignment with the board and management.

Comprehensive operational support:

- Work hand-in-hand with your team to stabilize operations, facilitating communications processes and ensuring seamless coordination between stakeholders.

- Create and enhance business plans, emphasizing cost reduction initiatives and execution milestones, while enforcing strict guidelines and controls for cash conservation.

Strategic pathway and execution:

- Manage actively creditor negotiations and evaluate avenues for revenue enhancement, aligning every step with an overarching operational restructuring plan.

- Serve as the linchpin in the restructuring process, quarterbacking the efforts to ensure a cohesive and timely execution of plans.

A&M takes quick actions, builds trust with stakeholders, and provides credible and practical advice to ensure lenders’ value.

- Conduct a rapid assessment of opportunity and risk, deep understanding of the situation.

- Act as representative for the lenders, provide negotiations support thought the restructuring process

- Identify alternatives for the lenders, understand ability of business and management to deliver

- Develop aggressive & realistic plans

- Negotiate adjustments and extensions for current facilities, optimizing working capital, obtaining and enhancing credit ratings, and exploring refinancing alternatives

- Keep creditors informed on company’s related progress and recent information

- Work with attorneys to ensure proper documentation and economics reflected from lenders perspective

- Advise on alternative structures

A&M takes quick actions, builds trust with stakeholders, and provides credible and practical advice to ensure lenders’ value.

- Conduct a rapid assessment of opportunity and risk, deep understanding of the situation.

-

Act as representative for the lenders, provide negotiations support thought the restructuring process.

- Identify alternatives for the lenders, understand ability of business and management to deliver.

- Develop aggressive & realistic plans.

- Negotiate adjustments and extensions for current facilities, optimizing working capital, obtaining and enhancing credit ratings, and exploring refinancing alternatives.

- Keep creditors informed on company’s related progress and recent information.

- Work with attorneys to ensure proper documentation and economics reflected from lenders perspective.

- Advise on alternative structures.

A&M takes quick actions, builds trust with stakeholders, and provides credible and practical advice to ensure lenders’ value.

- Conduct a rapid assessment of opportunity and risk, deep understanding of the situation.

-

Act as representative for the lenders, provide negotiations support thought the restructuring process.

-

Identify alternatives for the lenders, understand ability of business and management to deliver.

-

Develop aggressive & realistic plans.

-

Negotiate adjustments and extensions for current facilities, optimizing working capital, obtaining and enhancing credit ratings, and exploring refinancing alternatives.

-

Keep creditors informed on company’s related progress and recent information.

-

Work with attorneys to ensure proper documentation and economics reflected from lenders perspective.

-

Advise on alternative structures.

A&M takes quick actions, builds trust with stakeholders, and provides credible and practical advice to ensure lenders’ value.

- Conduct a rapid assessment of opportunity and risk, deep understanding of the situation.

-

Act as representative for the lenders, provide negotiations support thought the restructuring process.

- Identify alternatives for the lenders, understand ability of business and management to deliver.

- Develop aggressive & realistic plans.

- Negotiate adjustments and extensions for current facilities, optimizing working capital, obtaining and enhancing credit ratings, and exploring refinancing alternatives.

- Keep creditors informed on company’s related progress and recent information.

- Work with attorneys to ensure proper documentation and economics reflected from lenders perspective.

- Advise on alternative structures.

A&M takes quick actions, builds trust with stakeholders, and provides credible and practical advice to maximize the Company’s value.

- Conduct rapid assessment of opportunity and risk.

- Act with a deep understanding of the situation ensuring the company is accurately represented.

- Identify alternatives for the company, understand ability of business and management to deliver.

- Provide negotiations support through the restructuring process

- Ensure value for the company and shareholders.

- Enable communication and keep the company informed on creditor’s related progress and recent information.

- Work with attorneys to ensure proper documentation and economics reflected from the company’s perspective.

- Advise on alternative structures.

A&M executives bring a fresh action-oriented approach, an ability to develop game plans as well as the knowledge and expertise to execute them in an accelerated time frame while navigating turbulent times.

- Provide experienced professionals to act as a Chief Executive Officer (CEO), Chief Restructuring Officer (CRO), Chief Financial Officer (CFO), among others. These professionals will provide crucial stability and guidance to clients, customers, creditors and employees.

- Respond promptly to minimize adverse impact on executive turnover, overseeing communication processes with board members, management, creditors, and employees. If needed, handling financial and/or operational planning and administration.

- Immediate hiring of senior management personnel to provide interim leadership in functional areas according to the client's needs (i.e., CEO, CFO, COO, treasury, etc.). Rapid rapport with client teams, Always prepared for the unexpected, agile if corrections need to be made in the course of the consultancy.

- Monitor the company's operations from start to finish, developing and implementing strategies to enhance performance.

A&M offers comprehensive M&A services to support your buy- and sell-side transactions across the entire deal lifecycle.

M&A is a key enabler to business strategy. Providing assistance to assess the company’s businesses with fresh eyes and develop strategies that employ mergers, acquisitions and divestitures as a lever to improve enterprise performance and the competitive health of the business.

- Strategy: define and execute M&A strategies that support growth and improve performance, Advise Company / BOD in evaluation and execution of strategic alternatives.

- Valuation services: service a strong demand of independent valuation services, regardless of company size, industry, or asset type.

- M&A negotiation: act on experience in structuring and negotiating transactions, Senior members of the A&M team are extremely involved in this highly sensitive portion of any transaction.

- Transaction planning & execution: accelerate integration and separation activities to capture value.

- Value & optimization: realize the full potential of your transaction and optimize performance post-deal.

- Alliances: source JV and strategic alliance and undertake negotiations.

- Coordination of tax & legal matters: Manage and act as “quarterback” for transactions, ensuring that all parties act in congress and that no detail is overlooked.

A&M’s approach to financings is to obtain a variety of capital alternatives and arrays at the best terms available in the marketplace for our clients.

Our focus in corporate finance is to provide an in-depth offering of capital alternatives to our clients, on the best terms available in the market. As well as a varied array of services such as:

- Utilize and harness diverse network of potential capital providers, we facilitate a thorough auction process, which compels competing actors to “stretch” the amount of capital provided at each level of the capital structure.

- Public and private debt & equity placements.

- Through thorough financial analysis we fulfill our clients funding needs, and the optimization of their capital structure.

- Obtain, arrange, and manage DIP loans, special situation financing, revolver/term loans, subordinated debt, mezzanine debt and equity, assess and understand client capital needs.

A&M has a track record of successful asset management assignments in the region. Ready and willing to roll up our sleeves and work hand in hand with your team to achieve continuous success.

Service with experienced professionals acting as Chief Executive Officer (CEO), Chief Financial Officer (CFO), and Chief Restructuring Officer (CRO) to provide crucial stability and guidance to clients, customers, creditors and employees.

Provide services under the Asset Management Umbrella such as:

- Interim Management

- Liquidations

- Finance and Accounting

- Valuation Services

- Performance Improvement

- Corporate Governance

Daily tasks include and aren’t limited to: treasury management, budgeting and supplier payments, project management, bookkeeping, preparing board meetings and resolutions, liaison between law firms, auditors, and any other relevant party to comply with the applicable regulations, and various other management tasks.

A&M offers assistance and continuously seeks performance improvement in cases of high complexity for customized financial solutions, illiquid financial assets and asset management

Advice and guide companies, creditors and potential investors to capture and maximize value in distress situations and assets across a broad range of alternative investments. Through structured transactions, we seek to address asymmetries and inefficiencies, creating new opportunities.

Create and provide liquidity solutions, from simple asset sales to the structuring of complex assignments, for various asset classes including:

- Distressed credits.

- Non-performing loans.

- Judicial or arbitral claims.

- Credit rights.

- Investments in companies in financial or corporate restructuring.

A&M’s deep skills and experience in litigation consulting, business investigations, forensic technology and expert testimony, provide clients with the solutions they need.

A&M Disputes and Investigations professionals draw on their deep skills and experience to provide clients with the solutions they seek to achieve their goals. We confront your challenges, protect your interests and provide you with solutions that bring long-term value.

We assist in a wide range of services including:

- Damages calculation and valuation.

- Purchase price disputes.

- Business interruption.

- International arbitration.

- Forensic Procedures.

Conduct and revise rigorous accounting, financial and economic analysis to help resolve complex disputes – from the boardroom to the courtroom. Our experts are adept at providing in-depth analysis, quantum of damages, forensic accounting, valuation and expert testimony in litigation and international arbitration matters.

A&M’s team possesses the capabilities, industry knowledge and technical skills to provide specialized counsel on investment strategies, valuation services, risk management, and regulatory compliance for the alternative investments industry in North Latam.

Differentiate services by diversifying and developing expertise not solely depending on traditional offerings, which can pose higher risks, particularly in the face of market volatility. Within the array of services under the Alternate Investments Specialized Services (“AISS”) umbrella that we offer our clients, the following are the most pertinent:

- Capital Structure Advisory

- Project Financing

- Asset / Portfolio valuation to comply with regulatory requirements

- Specialized services for:

- Pension Funds

- Private Equity

- Hedge funds

- Debt funds

A&M’s approach to financings is to obtain a variety of capital alternatives and arrays at the best terms available in the marketplace for our clients.

Our focus in corporate finance is to provide an in-depth offering of capital alternatives to our clients, on the best terms available in the market. As well as a varied array of services such as:

- Utilize and harness diverse network of potential capital providers, we facilitate a thorough auction process, which compels competing actors to “stretch” the amount of capital provided at each level of the capital structure.

- Public and private debt & equity placements.

- Through thorough financial analysis we fulfill our clients funding needs, and the optimization of their capital structure.

- Obtain, arrange, and manage DIP loans, special situation financing, revolver/term loans, subordinated debt, mezzanine debt and equity, assess and understand client capital needs.

A&M has a track record of successful asset management assignments in the region. Ready and willing to roll up our sleeves and work hand in hand with your team to achieve continuous success.

Service with experienced professionals acting as Chief Executive Officer (CEO), Chief Financial Officer (CFO), and Chief Restructuring Officer (CRO) to provide crucial stability and guidance to clients, customers, creditors and employees.

Provide services under the Asset Management Umbrella such as:

- Interim Management

- Liquidations

- Finance and Accounting

- Valuation Services

- Performance Improvement

- Corporate Governance

Daily tasks include and aren’t limited to: treasury management, budgeting and supplier payments, project management, bookkeeping, preparing board meetings and resolutions, liaison between law firms, auditors, and any other relevant party to comply with the applicable regulations, and various other management tasks.

A&M offers assistance and continuously seeks performance improvement in cases of high complexity for customized financial solutions, illiquid financial assets and asset management

Advice and guide companies, creditors and potential investors to capture and maximize value in distress situations and assets across a broad range of alternative investments. Through structured transactions, we seek to address asymmetries and inefficiencies, creating new opportunities.

Create and provide liquidity solutions, from simple asset sales to the structuring of complex assignments, for various asset classes including:

- Distressed credits.

- Non-performing loans.

- Judicial or arbitral claims.

- Credit rights.

- Investments in companies in financial or corporate restructuring.

A&M’s deep skills and experience in litigation consulting, business investigations, forensic technology and expert testimony, provide clients with the solutions they need.

A&M Disputes and Investigations professionals draw on their deep skills and experience to provide clients with the solutions they seek to achieve their goals. We confront your challenges, protect your interests and provide you with solutions that bring long-term value.

We assist in a wide range of services including:

- Damages calculation and valuation.

- Purchase price disputes.

- Business interruption.

- International arbitration.

- Forensic Procedures.

Conduct and revise rigorous accounting, financial and economic analysis to help resolve complex disputes – from the boardroom to the courtroom. Our experts are adept at providing in-depth analysis, quantum of damages, forensic accounting, valuation and expert testimony in litigation and international arbitration matters.

A&M’s team possesses the capabilities, industry knowledge and technical skills to provide specialized counsel on investment strategies, valuation services, risk management, and regulatory compliance for the alternative investments industry in North Latam.

Differentiate services by diversifying and developing expertise not solely depending on traditional offerings, which can pose higher risks, particularly in the face of market volatility. Within the array of services under the Alternate Investments Specialized Services (“AISS”) umbrella that we offer our clients, the following are the most pertinent:

- Capital Structure Advisory

- Project Financing

- Asset / Portfolio valuation to comply with regulatory requirements

- Specialized services for:

- Pension Funds

- Private Equity

- Hedge funds

- Debt funds

Our differentiators:

- Experience reviewing compliance with credit agreements, and working collaboratively with management and creditors to address out of compliance facilities

- Working alongside a company’s management to develop a plan that is actionable

- Helping to stabilize financial and operational performance by developing and implementing comprehensive profitability and working capital plans

- Reassuring creditors that a company is taking important steps to maximize its value

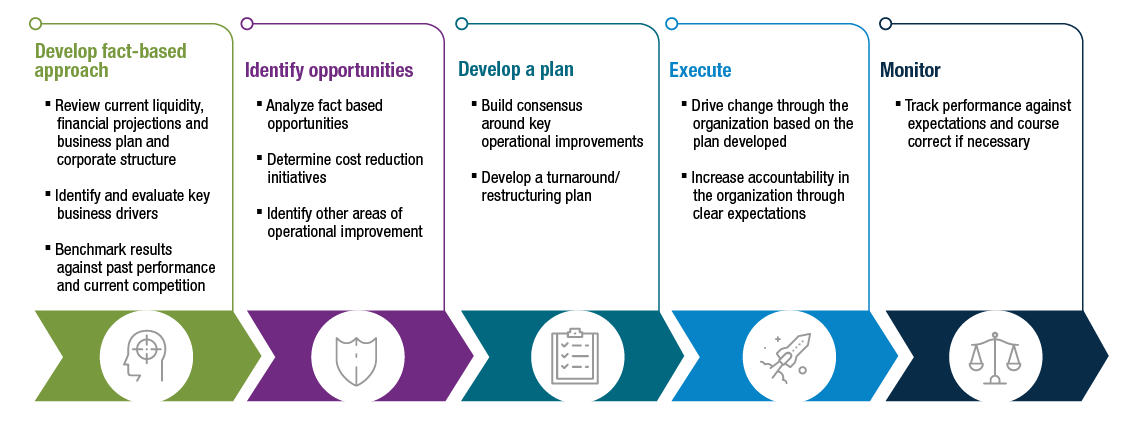

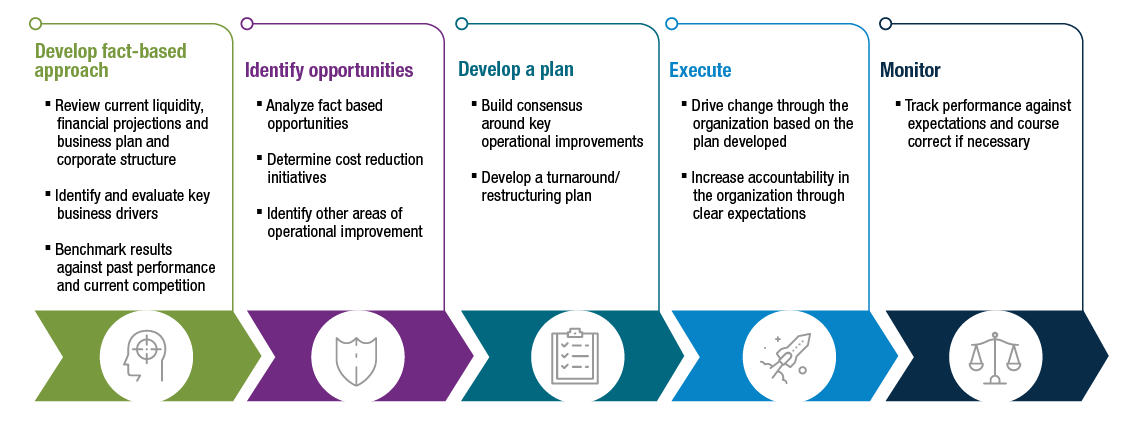

Our process:

With proven financial and operational restructuring experience, our process review is pragmatic and result-oriented. We develop and implement management action plans to maximize liquidity as well as the identification, evaluation, and execution of alternatives for management and board consideration.